This newsletter is sponsored by:

Growdy’s Predictions For 2026

Slate Auto Truck - Radical Simplicity Exemplified

1) Radical Simplicity, Cheaper Vehicles

Cars are expensive (thank you, Captain Obvious).

In Canada, prices came down a bit. But they came down to a still jaw-dropping $63,665 CAD on average.

In the US, prices have hit all-time highs of around $50,080 USD (or around $68,807 CAD).

What the world needs now is affordable vehicles. I don’t care if they are gas-powered, battery-powered, or powered by Mr Fusion.

Oh, wait, the rest of the world HAS affordable vehicles. They just aren’t available for sale in Canada or the US.

Slate Auto enters the chat.

Perhaps it’s time for the “slate-ification” of the North American auto industry.

Slate describes its truck vision as ‘radically simplified’. They aspire to build and sell a compact pick-up (that can convert to an SUV) for somewhere between $20,000 and $30,000 USD.

How do they manage to sell at that price? Remove everything that isn’t explicitly necessary.

No power windows.

No heated seats.

No infotainment system (although they will sell you a branded Bluetooth speaker).

And if you want some other bells and whistles, those will likely be available for sale on Amazon.com as after-sales accessories.

The truck might be available for sale on Amazon, too.

Several OEMs (I’m looking at you, Rivian, Ford, VW, Kia, and others) have been talking about building cheaper models for a couple of years, but those vehicles haven’t hit the road yet.

I predict that 2026 will bring a trend toward more stripped-down, affordable trim-level vehicles to meet the demand from cost-conscious buyers.

2) The Donald Is “Ready And Psyched” To Kill CUSMA (But Its Death Might Take Longer Than You Expect)

The Donald has had it in his head for a decade that he wants to kill free trade across North America. Since 2016, he’s called the standing free trade agreements “The worst trade deal in history.”

His plans were thwarted when friendly Mexican and polite Canadian leaders asked to renegotiate the North American Free Trade Agreement (NAFTA).

And the only thing The Donald likes more than Diet Coke is a good deal-making scheme. He disappointedly said back then, “You know I was really ready and psyched to terminate NAFTA.”

Thus, the Canada-United States-Mexico Agreement (CUSMA or USMCA, as the Yanks call it) was born, replacing NAFTA.

When The Donald signed CUSMA, he said, “This is a terrific deal for all of us.”

There were only a handful of differences between the two deals.

One of the most notable differences was the enforcement of a 75% country-of-origin rule for auto manufacturing.

For automobiles to enjoy tariff-free status under CUSMA, at least 75% of their parts had to come from North America.

NAFTA previously required 62.5%.

One of the intentions for CUSMA was to revitalize US manufacturing.

However, manufacturers across the US shed more than 576,000 jobs since The Donald signed the agreement.

Fast forward to 2026, and like NAFTA, The Donald is probably “ready and psyched” again to kill CUSMA.

Unlike in 2017, no one will argue against the orange man in the White House if he intends to pull out of the deal.

Economists suggest that ending CUSMA could have as severe an impact on the US as it would on Canada and Mexico. For that reason alone, they suggest the US won’t end the deal.

However, The Donald isn’t really troubled by concerns of how his policies impact his country.

Assuming the rules of the agreement are upheld, CUSMA does not automatically expire until 2036.

But the US could withdraw from the deal and give Canada and Mexico the obligatory six months’ notice.

In the interim, Canada and Mexico need to determine if there is a deal to be had with the US. Or work to extend more trade with other parts of the globe.

Mexico actually already has more free trade deals with more countries than any other nation in the world.

Canada, not so much.

Even if there is a deal to be had, there’s no guarantee the US will respect it, if recent events and The Donald’s 2025 “Liberation Day” tariffs are any indication of how Trump-o-nomics works in the wild.

3) Humanoid Robots Go To War

The 1X NEO Home Robot

Like I said back in November, Robots are so hot right now.

ICYMI: Morgan Stanley predicts that the humanoid robot business might be a $5 trillion market by 2050.

Today, there are hundreds of companies building or planning to build humanoid robots.

These companies want to put robots in our homes, in factories, on city streets, and on the moon.

In some cases, these robots are expected to be available for sale at prices cheaper than the price of a new car (for new car prices, see above).

In a LinkedIn post, Brett Adcock, CEO of the US robotics company Figure, outlined some robot-related developments he expects to see happen. In the post, Brett predicts that this year, “Humanoid robots will perform unsupervised, multi-day tasks in homes they’ve never seen before - driven entirely by neural networks. These tasks will span long time horizons, going straight from pixels to torques.”

As the New York Times reported recently, in the past year, drone warfare in Ukraine has undergone a chilling transformation.

But we haven’t seen humanoid robots hit the front lines, yet.

Outside of space robots and home chores, I predict we’ll see the first humanoid robots on the battlefield in 2026.

Also, some clever reporters asked an AI robot if we are in the middle of an AI bubble.

The robot said, “Only time will tell.”

Stupid robot.

4) Electric Vehicle Sales Growth Continues

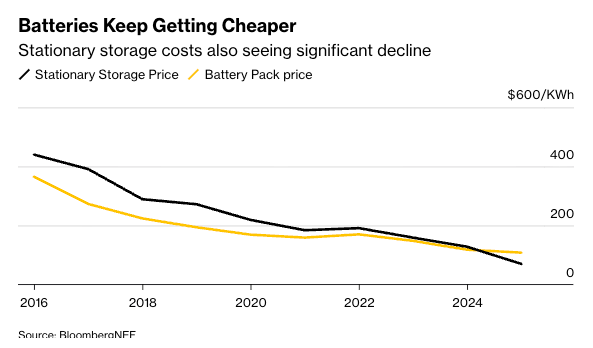

The global EV market has seen years of dramatic growth driven by increasingly affordable batteries, broader model availability, and consumer interest in a new type of vehicle.

In 2025 alone, EV sales worldwide are expected to surpass 20 million units, accounting for roughly one-quarter of total new car sales, with undeniably strong adoption.

However, the headline figures mask a more profound shift: growth rates are slowing in specific markets. Rather than doubling or rising by double digits year-over-year, as in earlier years, the pace of growth is easing as US and Canadian incentives fade and many consumers adjust to affordability realities.

At the same time, batteries keep getting cheaper.

New, more affordable models ARE being built (again, see above).

Add in lease returns and trade-ins, and that will increase the supply of used EVs, making big battery vehicles more affordable than ever.

Once someone catches the electric vehicle bug, they are increasingly less likely to return to an internal combustion engine vehicle.

“Despite the U.S. government introducing tariffs on vehicle imports and many governments removing the subsidies and incentives for purchasing EVs, the number of EVs on the road is forecast to increase 30% in 2026,” said Jonathan Davenport, Sr. Director Analyst at Gartner.

My prediction is that, regardless of incentives, we can expect to see more of those plug-in, big-battery cars driving around town.

5) Lithium Starts Being Displaced By Sodium

Today’s electric vehicles, cheap, expensive, or otherwise, use lithium in their battery chemistry.

However, CATL, the world’s largest manufacturer of EV batteries, changed the automotive world last year when it announced that it planned to start shipping sodium-ion batteries.

Sodium-based batteries are expected to be even cheaper than today’s cheapest lithium-based batteries.

Why is that?

Because sodium is abundant (the ground and our oceans are chock full of it) and way cheaper than lithium.

This is a bit of a softball prediction because of the somewhat obvious cost implications.

Regardless, in 2026, I predict that sodium-ion batteries will see large-scale adoption in battery swapping, passenger and commercial vehicles, and battery energy storage systems, making cleaner energy and the path to vehicle electrification even more cost-effective.

(Also, CATL predicts this too… and they are the ones making the batteries.)

6) China Secures Three Of The Top Ten Global Sales Spots

I made an aggressive prediction last year that BYD would become the world’s number one selling vehicle manufacturer.

It was a false prediction because it wasn’t possible. I was stressing a point to make a point.

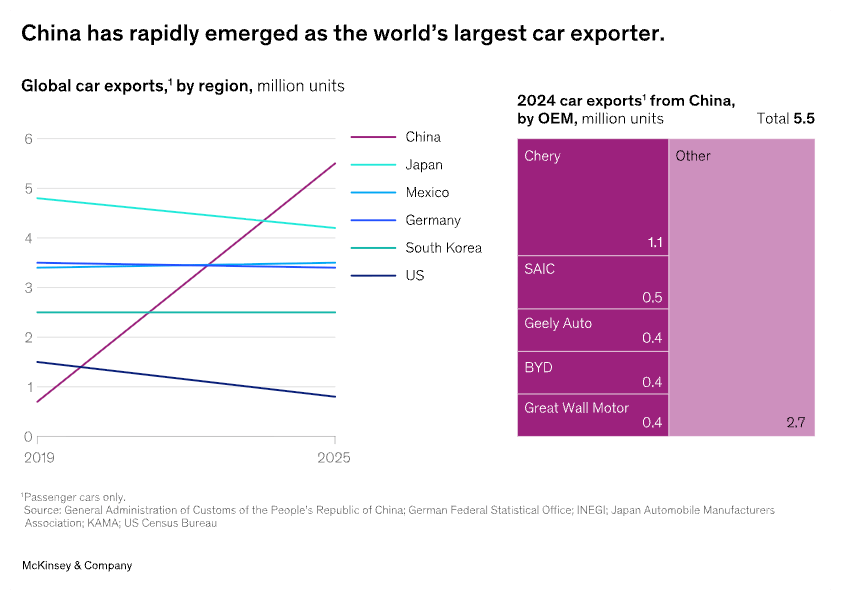

That said, China’s automotive industry has exploded.

Exports of Chinese vehicles have exploded along with it.

In 2024, China became the world’s largest exporter of vehicles.

In 2025, Chinese brands sold more than two million more vehicles globally than Japanese brands.

I expect there will be three Chinese brands among the top 10 manufacturers by the end of 2026.

If I were a betting man, those three companies are Geely, BYD, and Chery.

Give it a few more years, and more Chinese brands will rank among the top ten.

7) ALL Types Of Energy Get Cheaper, And You Still Won’t Notice

The one prediction I definitely got right last year was around the price of crude oil.

I predicted crude would get cheaper, and that you likely won’t notice it at the gas pumps because oil companies aren’t known for sharing their dividends with customers.

This year, all types of energy are likely to get cheaper.

How Low Can They Go?

Black Gold, Texas Tea

Crude oil will get cheaper.

Battery storage will get cheaper.

Solar will get cheaper.

Small Modular Nuclear Reactors (SMRs) won’t get cheaper. But they will allow for the production of more affordable electricity.

Again, unless you’re installing your own solar and battery storage system (which isn’t actually “cheap” when you initially install it), you won’t notice that all forms of energy are dropping in price.

Gas at the pumps won’t be cheaper.

And your electricity bill won’t drop much either.

But raw energy prices will continue to trend downward throughout 2026.

That’s It, And That’s All

I hope you enjoyed these predictions.

If you have any comments or responses, hit reply and let me know what you think.

If you know someone who might like to read The Change Optimist, forward this newsletter to them and ask them to subscribe.

Happy New Year!

Autograph Analytics is your AI-powered partner for automotive data, analytics and reporting.

They unify GA4, Ads, CRM and DMS data, turning scattered information into sleek, automated insights that drive smarter decisions.

Trusted by top dealer groups across North America, Autograph saves time, reduces errors and boosts performance. No spreadsheets. Just clean, intelligent reporting that moves as fast as you do.

Learn more at www.autographanalytics.com

You read to the bottom. Amazing!